Manama: Bahrain looks set to be cushioned from prolonged economic challenges facing Gulf markets mainly due to continued infrastructure investment, global property consulting firm CBRE has said.

In its Q4-2015 Bahrain MarketView for the quarter ended December last year, this investment was from the GCC Development Fund.

In a report on Sunday, the Economic Development Board said nearly $6 billion worth of projects under the GCC Development Fund, were allocated, $3.7bn worth had been tendered and $1.3bn worth had commenced, up from $300 million in the fourth quarter last year.

The fund comprises a $10bn aid package from GCC neighbours announced after the outbreak of unrest in 2011, often described as a GCC “Marshall Plan.”

Despite negative impacts of the on-going oil slump, the real estate sector in Bahrain has proven resilient.

Solid returns are still considered achievable, affording hard pressed investors the opportunity for potential growth in an otherwise unpredictable market.

This was underlined by the seven per cent growth achieved within the construction sector during early last year, as a raft of new development projects were launched across all real estate asset classes, but notably in the retail, hospitality and residential sectors.

“This growth was underpinned by investment in large scale infrastructure projects, supported by the $10bn GCC aid fund, including the multi-billion dollar Bahrain Airport expansion and the expansion of government affordable and social housing schemes, are also at the forefront of this trend,”

The retail sector continues to dominate real estate activity in Bahrain, with the fourth quarter witnessing several significant openings and new announcements.

“Community malls serving new residential districts continue to emerge as a dominant theme and nowhere is this more evident than in New Janabiya where no less than four separate malls under development or planned,”

“The 5,000sqm Al Mercado, anchored by Al Osra supermarket, is well underway and three other retail projects totalling nearly 50,000sqm of leasable space are being considered.”

According to the report, the December quarter heralded a period of consolidation in the hospitality sector, with no major new announcements but steady progress made towards the launch of two new developments early this year.

Amongst others, the Marriott Residence Inn at Water Garden City is also expected to be completed this year. Emaar Hospitality Group is also reportedly building five new hotels in the kingdom by the end of 2018, keeping Diyar Al Muharraq firmly in the property news.

The residential sector presents opportunities for investors to leverage key advantages that Bahrain enjoys over other GCC markets, with the retail and hospitality sectors rapidly approaching saturation point and the commercial office market still labouring amidst weak demand.

Quoting the InterNations Expat Insider Survey 2015, the report said Bahrain ranks highest in the Gulf for lifestyle, cost of living and education, at 17th globally ahead of the UAE, 19th and Oman, 24th.

“If you also consider that real estate costs per square metre for apartments in Bahrain average $2,072 and $5,037 in the UAE and that transaction costs are significantly lower in Bahrain, a case can be made for the residential sector offering potential investment opportunities, supported by a low real estate cost base, attractive business costs and Bahrain’s popularity as a place to live for Mena and western expatriate families and bachelors,”

Opportunities also exist in the compound villa sector with strong occupancy levels in areas popular with expatriates, especially those with good access to the Saudi Causeway and popular schools.

Prime apartment sub markets also continue to fare well with Reef Island retaining its position as the most expensive apartment location, supported by strong demand.

In addition, Amwaj Islands is emerging from a relatively dormant period with an increase in construction activity in the residential sector, underlining its continuing popularity as a lifestyle destination. The commercial office market continues to face stiff challenges with downside risks again appearing on the horizon.

Budgets to fund ministry office projects may also be affected by the widely discussed cuts in short to medium-term government spending.

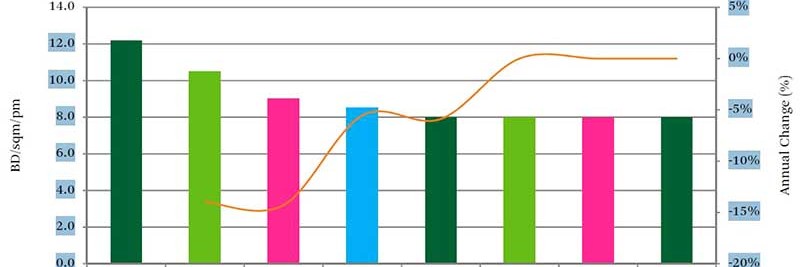

“Average rentals for leading Grade A projects remain stable for now, typically quoted at between BD7 and 9 per sqm. Although, it is difficult to see how these levels can be maintained, with downward pressure on demand and with an additional 70,000sqm of office space in Bahrain Bay and Seef coming on stream during the first half,”

Source: GDNonline