A new $80-million serviced apartment project on Amwaj Islands in Bahrain has officially opened its doors to receive guests.

Developed by Lona Real Estate, owners of the Amwaj Waves Development, and managed by Gulf Hotels Group, the Gulf Residence Amwaj offers travellers luxury accommodation for both long and short stays.

The new development comprises two luxury four star hotel apartment buildings featuring 173 spacious suites and apartments which include one studio residence, 43 one-bedroom residence, 107 two-bedroom residence and 18 three-bedroom suites, in addition to four luxurious four-bedroom and six-bedroom penthouse suites. All suites and apartments have been designed in a modern, contemporary style with a focus on quality family living and functionality.

Facilities include an exquisitely landscaped swimming pool deck, fitness centre, Mediterranean restaurant “Waves by the Pool”, cafe, boutique shops & salons, meeting and banquet rooms and ample parking space.

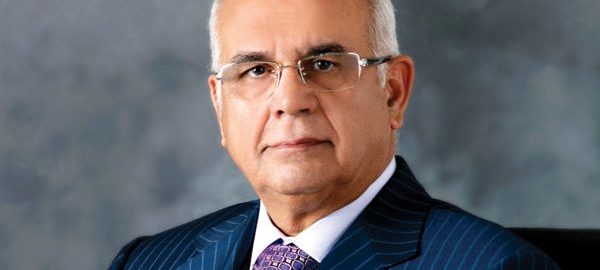

“The Gulf Residence Amwaj is managed by the Gulf Hotels Group and is one of the new projects in line with the group’s expansion strategy of adding hotels and luxury apartments in key locations,” said Gulf Hotels Group chief executive officer and board member, Aqeel Raees. “Gulf Residence Amwaj is one of the latest additions to join the group’s exclusive collection of unique independent properties and will not only offer guests every comfort, but also excellent value for money. The service will mirror the group’s core philosophy of providing five-star services for four-star pricing”

Other facilities include a health club with sauna and steam rooms, children’s pool, Jacuzzi, in addition to a number of food and soft beverage outlets and luxurious commercial area. Concierge service and valet parking is available for the convenience of all guests.

Abdulla Buhindi, chairman of Lona Real Estate, said: “Amwaj Islands is a fantastic location for both long stay and short stay visitors to Bahrain. We are looking forward to the renowned expertise of the Gulf Hotel team to make the Gulf Residence Amwaj a premier family destination on Amwaj Islands.”

Source: Tardearabia.com