Bahrain authorities have started work on the North Town Entrance Roads Revamp Project (W-Link) being funded by the Kuwaiti Fund for Arab Economic Development (as part of the Gulf Development Programme).

The BD7.69 million ($20.2 million) project, which will cater to 5,000 housing units in the Northern Governorate of the kingdom, was awarded to Al Ghanim International Company and Haj Hassan Group (who will be in charge of implementation).

It is part of the ministry’s plan to provide quality infrastructure services across the kingdom, said Essam bin Abdulla Khalaf, the Minister of Works, Municipalities Affairs & Urban Planning after inaugurating the project.

The event was attended by Ahmed Al Khayyat, the Works Affairs undersecretary and Huda Fakhro, the Roads assistant undersecretary along with the the supervising team of engineers from the ministry, the project consultant and representatives from Haj Hassan Group and Al Ghanim Kuwaiti Company.

The project involves construction of a 1.2-km-long road with four lanes on each direction; connecting Janabiya and Budaiya Interchange to the North Town, he stated.

A 135-m-long bridge will be constructed above the marine channel to provide a smooth traffic flow besides increasing the road capacity.

According to officials, a building belonging to the Ministry of Agriculture will be demolished to make way for the project.

The ministry is presently reviewing the final designs and documents for the project to construct an alternative building, they added.

Also, the ministry has recently commenced work on a 2.2-km-long service road along Salmabad Avenue; leading to Road 1206 in Block 712 at the Northern Governorate.

The project comprises levelling and asphalting works, implementation of a storm water drainage network and ground channels for future use besides construction of pavements, signage and painting ground markings.

The BD309,713 ($814,755) project was awarded to Jahicon Engineering Services.

Source: Trade Arabia

Bahrain-based Property Management company Impact Estate has launched a new integrated Property Management Platform designed to accommodate all Landlords’ needs, the company said in a statement.

According to the company, the new property management solution allows Managers and Landlords of residential and commercial properties with one touch of a button to take complete control of every aspect of their business, including the rent, vacancy and maintenance cycles.

The move also allows Landlords to see the status of the property including occupancy, rental collection, on-going maintenance tasks and financial reports of income and expenses online or through the mobile application. Moreover, it provides tenants with a hassle-free platform to submit maintenance inquiries, check payment status and access the lease-related documents, the statement added.

Impact Estate said it offers mobile-friendly services allowing access on tablets, phones or desktop computers. Property Managers, Tenants and Landlords can efficiently interact with each other without leaving their houses and offices.

The company also said it is the first in the region to implement this innovative Property Management Platform designed to create a new convenient communication environment for all parties involved in the property management process including Tenants, Landlords and Property Manager. Created with customers in focus the new Property Management System in one more step to take the Property Management Services in Bahrain to an advanced international level.

Savio Fernandez, Head of Property Management Department says: “The new service allows us to monitor all transaction as well as to interact with tenants and property owners on line at any time of the day and in any part of the world. We believe that the new service will allow Impact Estate to create an unprecedented level of customer service in the region.”

A new $80-million serviced apartment project on Amwaj Islands in Bahrain has officially opened its doors to receive guests.

Developed by Lona Real Estate, owners of the Amwaj Waves Development, and managed by Gulf Hotels Group, the Gulf Residence Amwaj offers travellers luxury accommodation for both long and short stays.

The new development comprises two luxury four star hotel apartment buildings featuring 173 spacious suites and apartments which include one studio residence, 43 one-bedroom residence, 107 two-bedroom residence and 18 three-bedroom suites, in addition to four luxurious four-bedroom and six-bedroom penthouse suites. All suites and apartments have been designed in a modern, contemporary style with a focus on quality family living and functionality.

Facilities include an exquisitely landscaped swimming pool deck, fitness centre, Mediterranean restaurant “Waves by the Pool”, cafe, boutique shops & salons, meeting and banquet rooms and ample parking space.

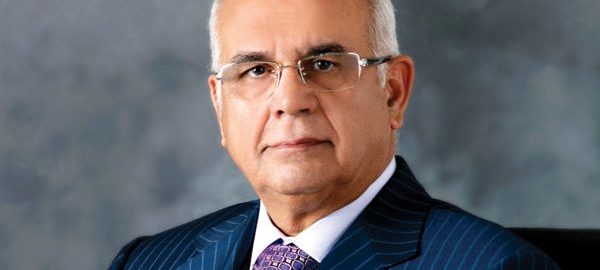

“The Gulf Residence Amwaj is managed by the Gulf Hotels Group and is one of the new projects in line with the group’s expansion strategy of adding hotels and luxury apartments in key locations,” said Gulf Hotels Group chief executive officer and board member, Aqeel Raees. “Gulf Residence Amwaj is one of the latest additions to join the group’s exclusive collection of unique independent properties and will not only offer guests every comfort, but also excellent value for money. The service will mirror the group’s core philosophy of providing five-star services for four-star pricing”

Other facilities include a health club with sauna and steam rooms, children’s pool, Jacuzzi, in addition to a number of food and soft beverage outlets and luxurious commercial area. Concierge service and valet parking is available for the convenience of all guests.

Abdulla Buhindi, chairman of Lona Real Estate, said: “Amwaj Islands is a fantastic location for both long stay and short stay visitors to Bahrain. We are looking forward to the renowned expertise of the Gulf Hotel team to make the Gulf Residence Amwaj a premier family destination on Amwaj Islands.”

Source: Tardearabia.com

April 2016, Manama, Kingdom of Bahrain: Impact Estate has taken part in the 2016 Gulf Property Show along with their sister company Impact Interiors. Both companies have showcased extremely exceptional products. Impact estate have exhibited two of their exclusive projects, Modern Residence 2, whose completion date is in 30 days and Rayyan Residence whose completion will be the end of July, both located in the heart of Amwaj. As well as these residential projects, Estate will be launching new UK developments located in Manchester, Leeds and Liverpool. These properties range from buy-to-let and student accommodation at very affordable prices.

Additionally Impact Interiors have exhibited ‘Furniche by Interiors’ which was established in 2013 to bring the best quality furniture and fittings to the customers door step. Their Interior design background, combined with their extensive experience in the FF&E procurement sector is the underlying factor that differentiates them from the rest.

The exhibition is taking place at the Bahrain International Exhibition and Convention Centre on April 26th-28th of April.

Oksana A.K., General Manager of Impact Estate says: “We are excited to offer new projects in the best district of Bahrain to our clients. Even though Bahrain is very attractive in terms of property investments, some buyer are looking for real estate outside of the Kingdom. Now, with our new international projects we can cater to a wider specter of clientele.”